The Lodging Slowdown: Travel Services Take the Lead in 2025’s Volatile Market

- Tatiana Morfin

- Aug 1, 2025

- 2 min read

Updated: Aug 21, 2025

The hospitality and travel industries are moving forward in 2025, but not at the same pace. According to Yahoo Finance sector data, the gap between Lodging (hotels, resorts, accommodations) and Travel Services (online travel agencies, cruise lines, airlines) is widening. Hotels are still facing serious challenges, while travel platforms and cruise operators are adapting faster and showing stronger stock performance.

Hotel Stocks Face Downward Pressure Despite Growing Travel Demand

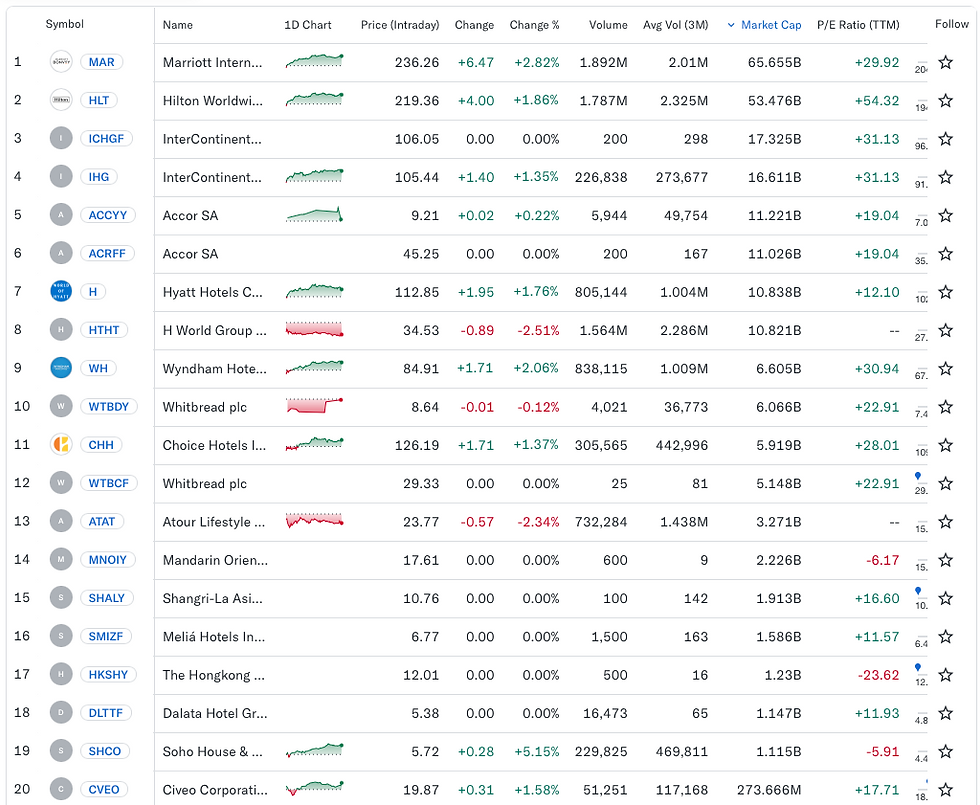

Leading hotel brands like Marriott International (MAR), Hilton Worldwide (HLT), Hyatt Hotels (H), and Wyndham Hotels & Resorts (WH) are under significant financial pressure. Yahoo Finance reports that lodging stocks have posted negative returns in 2025, trailing broader indices like the S&P 500.

Why are hotel stocks down when people are traveling again? The answer lies in rising operational costs, labor shortages, and weak growth in RevPAR (Revenue per Available Room). Hotels are grappling with higher expenses and competitive pricing pressures, which is affecting their profitability. This has led to a decline in hotel stock prices, creating a cautious outlook for the lodging sector.

Travel Services Stocks Are Outperforming Hotels in 2025

On the flip side, the Travel Services sector, which includes online travel agencies (OTAs), cruise lines, airlines, and tour operators, is showing more resilience. According to Yahoo Finance, companies like Booking Holdings (BKNG), Expedia Group (EXPE), Airbnb (ABNB), and Tripadvisor (TRIP) are seeing stronger stock performance compared to traditional hotel chains.

Booking Holdings stock has gained double digits year-to-date, thanks to solid Q2 earnings and increasing global travel bookings.

Airbnb remains a key player in the alternative lodging market, holding steady despite market volatility.

Tripadvisor’s recent stock surge, driven by activist investor involvement, reflects renewed investor confidence.

Cruise companies like Royal Caribbean (RCL) are capitalizing on consumer demand for value-driven vacation packages.

These companies benefit from asset-light business models, which allow them to be more agile in pricing strategies and market positioning.

Why Lodging Stocks Lag Behind While Travel Services Surge

The structural difference between Lodging and Travel Services is a key factor behind their diverging performance in 2025. Hotel chains are asset-heavy, with high fixed costs tied to property management and staffing. This makes it harder for them to pivot quickly when market dynamics shift.

In contrast, OTAs like Booking.com and Airbnb operate with fewer physical assets, allowing them to scale faster and adjust to changing traveler behaviors. Cruise operators, while managing large fleets, offer bundled experiences that appeal to cost-conscious consumers looking for all-in-one vacation solutions.

Investors are rewarding this flexibility. While hotel stocks face a cautious “hold” sentiment, Travel Services stocks are seeing selective optimism from analysts who favor digital platforms and scalable models.

Conclusion: Lodging and Travel Are Moving at Different Speeds

The hospitality industry in 2025 is moving at two different speeds. Hotels are battling high operational costs and limited flexibility, while Travel Services companies—especially OTAs and cruise lines—are leveraging asset-light models to stay ahead.

According to Yahoo Finance, this divergence is likely to continue, with travel platforms and cruise operators maintaining an edge over traditional lodging brands. For the rest of the year, companies that can adapt quickly to demand shifts and optimize their cost structures will lead the industry’s momentum.

Comments